Ministry of Public Business Sector in 2025

Ministry of Public Business Sector in 2025:

A Year of Achievements

Significant improvement in performance and production, support for national industry, and maximization of returns on state assets

• EGP 126 billion in revenues of affiliated companies, with growth of around 20%

• Net profits of approximately EGP 24 billion in FY 2024–2025

• Exports increased by USD 1 billion, a growth rate of 27%

• Reviving and developing numerous assets, restarting factories halted for years, and localizing strategic industries

• Noticeable progress in project implementation across various sectors and the launch of new projects

• Strengthening partnerships with the private sector and attracting foreign investments

The year 2025 witnessed a broad harvest of achievements and successes by the Ministry of Public Business Sector and its affiliated companies across various industrial, productive, and service sectors. This year reflected a qualitative shift in financial and operational performance, a significant increase in production capacities and competitiveness, accelerated implementation of investment projects, and the execution of numerous programs to enhance technical and human efficiency. These efforts included modernizing factories and production lines, restructuring boards of directors, reviving and developing long-idle industrial and tourism assets, restarting strategic factories, and maximizing the economic return on state assets. All of this contributes to deepening local manufacturing, increasing exports, supporting national industry, and enhancing the contribution of state-owned companies to the national economy.

This positive performance comes within the framework of implementing the Ministry’s strategy derived from Egypt Vision 2030 for Sustainable Development, the Government Action Program, and the State Ownership Policy Document. These directions were translated into clear executive strategies within the affiliated holding companies: the Holding Company for Metallurgical Industries, the Holding Company for Chemical Industries, the Holding Company for Pharmaceuticals, Chemicals, and Medical Supplies, the Holding Company for Cotton, Spinning, Weaving, and Apparel, the Holding Company for Tourism and Hotels, and the Holding Company for Construction and Development. The aim is to improve operational efficiency, maximize returns on state investments, and entrench principles of governance, sustainability, and occupational safety.

Preliminary indicators for FY 2024–2025 showed that affiliated companies achieved total revenues of approximately EGP 126 billion, with growth of nearly 20% compared to the previous year, while consolidated net profits reached around EGP 24 billion. Exports increased by 27% to about USD 1 billion, reflecting the achievement and surpassing of targets in revenues, profits, exports, and private-sector partnerships. This indicates continuous improvement in the production and marketing performance of affiliated companies and their ability to compete in foreign markets through expansion into new regional and international markets and increased reliance on value-added products. The total market capitalization of affiliated companies listed on the Egyptian Exchange rose by about 36%, alongside the return to profitability of several major companies, including El Nasr Automotive—for the first time in decades—Sidi Kerir Petrochemicals (SIDPEC), and El Nasr General Contracting (Hassan Allam).

During 2025, the Ministry placed special emphasis on reviving and developing long-idle industrial assets, foremost among them the completion of revival and development projects at El Nasr Automotive, which returned to operation and production in the last quarter of 2024 after more than 15 years of stoppage. The company expanded the production of “Nasr Sky” tourist buses to international specifications, increasing the local component from 52% to 63.5% within one year, and contracted to manufacture and supply 250 buses to East and West Delta Transport and Tourism companies, in addition to supplies for other entities. New products were added, such as the “Nasr Star” minibus with a local component exceeding 70%, with the first batch delivered to New Alamein City. Preparations also began for the production of electric buses and minibuses, alongside the completion of a comprehensive upgrade of the passenger car factory, equipping it with the latest assembly, welding, and painting lines, and conducting trial operations on vehicle models for El Nasr and other brands. The Egyptian Company for Carbon Anode Blocks in the Suez Canal Economic Zone at Ain Sokhna was also restarted after more than two and a half years of stoppage, following comprehensive rehabilitation works. An agreement was activated with BP (British Petroleum) to calcine green petroleum coke for five years, renewable. Operations began in October 2025 with a design capacity of 150,000 tons per year in the first phase, with a plan to double production to 300,000 tons per year by the first quarter of 2026. The company exported its first shipment in December 2025.

In Aswan, the ferrosilicon plant at the Egyptian Chemical Industries Company (KIMA) was restarted in April 2025 after nearly five years of stoppage, contributing to value addition for local raw materials and import substitution of silicon manganese alloys used in the steel industry. The plant was rehabilitated by the Egyptian Ferroalloys Company at a cost of approximately EGP 53 million, and an agreement was signed with Al Sharq Al Haqiqi Company (an Egyptian company with Saudi investments) to operate the plant at a targeted production capacity of 18,000 tons per year, generating returns of around USD 1.8 million annually for KIMA.

In the pharmaceutical sector, El Nasr Pharmaceutical Chemicals Company was revived as part of the strategy to localize drug manufacturing and enhance pharmaceutical security. The comprehensive development included four new and upgraded factories in line with Good Manufacturing Practice (GMP) standards, which were inaugurated and operated in October 2025. Investments in development and modernization projects within the pharmaceutical holding companies exceeded EGP 3 billion, covering the upgrade of 97 production lines in compliance with international GMP standards. This supports export growth, the registration of 18 new products, the resumption of dozens of discontinued medicines, and the modernization of drug portfolios to meet the needs of the Egyptian market at affordable prices. A joint venture agreement was also signed in May 2025 between the Pharmaceutical Holding Company and Dawah Pharma (USA) to manufacture and export pharmaceuticals and dietary supplements to global markets. In the field of medical supplies localization, a Egyptian–Qatari–American partnership agreement was signed in October 2025 to establish an integrated medical manufacturing ecosystem, enhancing Arab and international industrial integration and localizing medical technology.

The year 2025 also saw accelerated progress in the national project to develop the spinning and weaving industry. First-phase factories were fully operational, and work advanced on the second phase, with the completion and operation of the new “Spinning 2” factory at Misr Shebin El-Kom Spinning and Weaving Company, with a production capacity of 10 tons per day. Final preparations are underway in the remaining factories at Misr Spinning and Weaving Company in El-Mahalla El-Kubra, with trial operations starting at the textile complex and Textile Preparations Factory 2, and installation works nearing completion at dyeing factories and Spinning 6, in preparation for operation in the coming days. Significant progress was also achieved in the third phase, which includes developing other spinning and weaving companies across several governorates, using the latest global technologies and integrated infrastructure. Partnerships were established with foreign and Egyptian investors, including an agreement in April 2025 with Misr Artificial Silk and Polyester Fibers Company to establish two companies for recycling plastic and textile waste. The industrial felt factory is expected to be completed in July 2026, and the polyester fibers factory in March 2027.

In the metallurgical industries sector, Egyptalum in Nagaa Hammadi witnessed several development and expansion projects, including the operation of a new aluminum wire production line with a capacity of 60,000 tons per year, projects to produce pharmaceutical packaging discs, cold rolling, alumina silos, aluminum scrap recycling, and rehabilitation of the current smelter to ensure production continuity until 2045. An agreement was also signed to establish a 1 GW solar power plant in cooperation with Scatec of Norway, with investments of USD 650 million, to supply the complex with clean energy, supporting environmental sustainability and export growth. Work also progressed on the phosphate ore upgrading project in partnership with Wilson (India). The steel and cast iron foundry at Delta Steel Company was operated with a capacity of 10,000 tons per year, and the fifth furnace project at the Egyptian Ferroalloys Company is being prepared to increase production by 30%, with a capacity of 15,000 tons per year.

In the chemical industries sector, progress continued on the ammonia compressor rehabilitation project at El Nasr Fertilizers Company in Suez, aiming to double production capacity to 400 tons per day, with trial operations expected in March 2026. Work also accelerated on the nitric acid and ammonium nitrate project at KIMA, including a 600-ton/day nitric acid unit and an 800-ton/day ammonium nitrate unit. A LED lighting components production line at Niaza was launched in May 2025, and the production of 200,000 rail fasteners for the high-speed rail project was awarded to Sigwart Company, valued at EGP 740 million. Contracts were signed in August 2025 with Capsom (China) for Egypt’s first chlorine granules factory, and financing agreements were concluded with the National Bank of Egypt and CIB in November 2025.

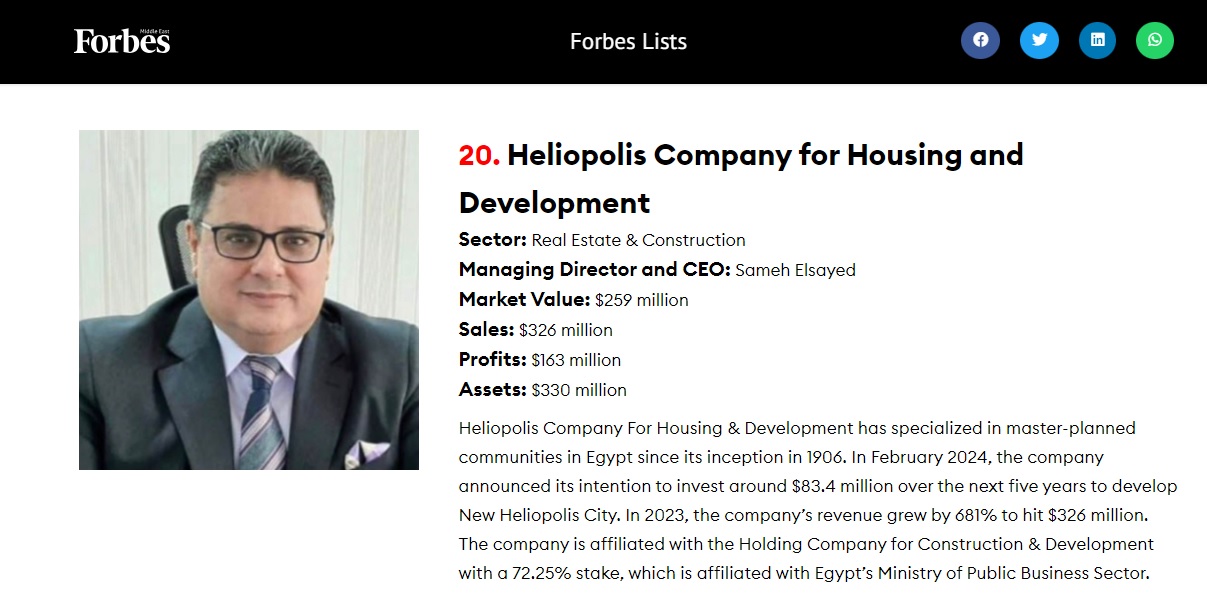

In the tourism and hotels sector, the Ministry continued to maximize returns on tourism assets through hotel development, including the completion and operation of hotels in Ras El Bar and Abu Simbel, launching the revival of the historic Continental Hotel in downtown Cairo under the Taj brand, accelerating work on the Shepheard Hotel, expanding hotel capacity in several locations, and upgrading tourism transport fleets. In the construction and real estate development sector, affiliated companies continued implementing major national projects, including “Haya Karima”, expanding operations abroad, and achieving notable progress in real estate development projects. Highlights include launching a new visual identity for Misr Al Gadida Company, reopening Ghurnata Palace on its 120th anniversary, and launching the “Jadinah” project in New Heliopolis. In conclusion, the 2025 achievements affirm the Ministry of Public Business Sector’s commitment to continuing comprehensive reform and development, maximizing the value of state assets, strengthening partnerships with the private sector, and attracting international investments—supporting the national economy and achieving sustainable development within the framework of the New Republic.

• EGP 126 billion in revenues of affiliated companies, with growth of around 20%

• Net profits of approximately EGP 24 billion in FY 2024–2025

• Exports increased by USD 1 billion, a growth rate of 27%

• Reviving and developing numerous assets, restarting factories halted for years, and localizing strategic industries

• Noticeable progress in project implementation across various sectors and the launch of new projects

• Strengthening partnerships with the private sector and attracting foreign investments

The year 2025 witnessed a broad harvest of achievements and successes by the Ministry of Public Business Sector and its affiliated companies across various industrial, productive, and service sectors. This year reflected a qualitative shift in financial and operational performance, a significant increase in production capacities and competitiveness, accelerated implementation of investment projects, and the execution of numerous programs to enhance technical and human efficiency. These efforts included modernizing factories and production lines, restructuring boards of directors, reviving and developing long-idle industrial and tourism assets, restarting strategic factories, and maximizing the economic return on state assets. All of this contributes to deepening local manufacturing, increasing exports, supporting national industry, and enhancing the contribution of state-owned companies to the national economy.

This positive performance comes within the framework of implementing the Ministry’s strategy derived from Egypt Vision 2030 for Sustainable Development, the Government Action Program, and the State Ownership Policy Document. These directions were translated into clear executive strategies within the affiliated holding companies: the Holding Company for Metallurgical Industries, the Holding Company for Chemical Industries, the Holding Company for Pharmaceuticals, Chemicals, and Medical Supplies, the Holding Company for Cotton, Spinning, Weaving, and Apparel, the Holding Company for Tourism and Hotels, and the Holding Company for Construction and Development. The aim is to improve operational efficiency, maximize returns on state investments, and entrench principles of governance, sustainability, and occupational safety.

Preliminary indicators for FY 2024–2025 showed that affiliated companies achieved total revenues of approximately EGP 126 billion, with growth of nearly 20% compared to the previous year, while consolidated net profits reached around EGP 24 billion. Exports increased by 27% to about USD 1 billion, reflecting the achievement and surpassing of targets in revenues, profits, exports, and private-sector partnerships. This indicates continuous improvement in the production and marketing performance of affiliated companies and their ability to compete in foreign markets through expansion into new regional and international markets and increased reliance on value-added products. The total market capitalization of affiliated companies listed on the Egyptian Exchange rose by about 36%, alongside the return to profitability of several major companies, including El Nasr Automotive—for the first time in decades—Sidi Kerir Petrochemicals (SIDPEC), and El Nasr General Contracting (Hassan Allam).

During 2025, the Ministry placed special emphasis on reviving and developing long-idle industrial assets, foremost among them the completion of revival and development projects at El Nasr Automotive, which returned to operation and production in the last quarter of 2024 after more than 15 years of stoppage. The company expanded the production of “Nasr Sky” tourist buses to international specifications, increasing the local component from 52% to 63.5% within one year, and contracted to manufacture and supply 250 buses to East and West Delta Transport and Tourism companies, in addition to supplies for other entities. New products were added, such as the “Nasr Star” minibus with a local component exceeding 70%, with the first batch delivered to New Alamein City. Preparations also began for the production of electric buses and minibuses, alongside the completion of a comprehensive upgrade of the passenger car factory, equipping it with the latest assembly, welding, and painting lines, and conducting trial operations on vehicle models for El Nasr and other brands. The Egyptian Company for Carbon Anode Blocks in the Suez Canal Economic Zone at Ain Sokhna was also restarted after more than two and a half years of stoppage, following comprehensive rehabilitation works. An agreement was activated with BP (British Petroleum) to calcine green petroleum coke for five years, renewable. Operations began in October 2025 with a design capacity of 150,000 tons per year in the first phase, with a plan to double production to 300,000 tons per year by the first quarter of 2026. The company exported its first shipment in December 2025.

In Aswan, the ferrosilicon plant at the Egyptian Chemical Industries Company (KIMA) was restarted in April 2025 after nearly five years of stoppage, contributing to value addition for local raw materials and import substitution of silicon manganese alloys used in the steel industry. The plant was rehabilitated by the Egyptian Ferroalloys Company at a cost of approximately EGP 53 million, and an agreement was signed with Al Sharq Al Haqiqi Company (an Egyptian company with Saudi investments) to operate the plant at a targeted production capacity of 18,000 tons per year, generating returns of around USD 1.8 million annually for KIMA.

In the pharmaceutical sector, El Nasr Pharmaceutical Chemicals Company was revived as part of the strategy to localize drug manufacturing and enhance pharmaceutical security. The comprehensive development included four new and upgraded factories in line with Good Manufacturing Practice (GMP) standards, which were inaugurated and operated in October 2025. Investments in development and modernization projects within the pharmaceutical holding companies exceeded EGP 3 billion, covering the upgrade of 97 production lines in compliance with international GMP standards. This supports export growth, the registration of 18 new products, the resumption of dozens of discontinued medicines, and the modernization of drug portfolios to meet the needs of the Egyptian market at affordable prices. A joint venture agreement was also signed in May 2025 between the Pharmaceutical Holding Company and Dawah Pharma (USA) to manufacture and export pharmaceuticals and dietary supplements to global markets. In the field of medical supplies localization, a Egyptian–Qatari–American partnership agreement was signed in October 2025 to establish an integrated medical manufacturing ecosystem, enhancing Arab and international industrial integration and localizing medical technology.

The year 2025 also saw accelerated progress in the national project to develop the spinning and weaving industry. First-phase factories were fully operational, and work advanced on the second phase, with the completion and operation of the new “Spinning 2” factory at Misr Shebin El-Kom Spinning and Weaving Company, with a production capacity of 10 tons per day. Final preparations are underway in the remaining factories at Misr Spinning and Weaving Company in El-Mahalla El-Kubra, with trial operations starting at the textile complex and Textile Preparations Factory 2, and installation works nearing completion at dyeing factories and Spinning 6, in preparation for operation in the coming days. Significant progress was also achieved in the third phase, which includes developing other spinning and weaving companies across several governorates, using the latest global technologies and integrated infrastructure. Partnerships were established with foreign and Egyptian investors, including an agreement in April 2025 with Misr Artificial Silk and Polyester Fibers Company to establish two companies for recycling plastic and textile waste. The industrial felt factory is expected to be completed in July 2026, and the polyester fibers factory in March 2027.

In the metallurgical industries sector, Egyptalum in Nagaa Hammadi witnessed several development and expansion projects, including the operation of a new aluminum wire production line with a capacity of 60,000 tons per year, projects to produce pharmaceutical packaging discs, cold rolling, alumina silos, aluminum scrap recycling, and rehabilitation of the current smelter to ensure production continuity until 2045. An agreement was also signed to establish a 1 GW solar power plant in cooperation with Scatec of Norway, with investments of USD 650 million, to supply the complex with clean energy, supporting environmental sustainability and export growth. Work also progressed on the phosphate ore upgrading project in partnership with Wilson (India). The steel and cast iron foundry at Delta Steel Company was operated with a capacity of 10,000 tons per year, and the fifth furnace project at the Egyptian Ferroalloys Company is being prepared to increase production by 30%, with a capacity of 15,000 tons per year.

In the chemical industries sector, progress continued on the ammonia compressor rehabilitation project at El Nasr Fertilizers Company in Suez, aiming to double production capacity to 400 tons per day, with trial operations expected in March 2026. Work also accelerated on the nitric acid and ammonium nitrate project at KIMA, including a 600-ton/day nitric acid unit and an 800-ton/day ammonium nitrate unit. A LED lighting components production line at Niaza was launched in May 2025, and the production of 200,000 rail fasteners for the high-speed rail project was awarded to Sigwart Company, valued at EGP 740 million. Contracts were signed in August 2025 with Capsom (China) for Egypt’s first chlorine granules factory, and financing agreements were concluded with the National Bank of Egypt and CIB in November 2025.

In the tourism and hotels sector, the Ministry continued to maximize returns on tourism assets through hotel development, including the completion and operation of hotels in Ras El Bar and Abu Simbel, launching the revival of the historic Continental Hotel in downtown Cairo under the Taj brand, accelerating work on the Shepheard Hotel, expanding hotel capacity in several locations, and upgrading tourism transport fleets. In the construction and real estate development sector, affiliated companies continued implementing major national projects, including “Haya Karima”, expanding operations abroad, and achieving notable progress in real estate development projects. Highlights include launching a new visual identity for Misr Al Gadida Company, reopening Ghurnata Palace on its 120th anniversary, and launching the “Jadinah” project in New Heliopolis. In conclusion, the 2025 achievements affirm the Ministry of Public Business Sector’s commitment to continuing comprehensive reform and development, maximizing the value of state assets, strengthening partnerships with the private sector, and attracting international investments—supporting the national economy and achieving sustainable development within the framework of the New Republic.